With LiquidShare, Ivey MBAs are aiming to democratise spirits investing through factional ownership of maturing whiskey casks.

Investors are always looking for the next big thing. Today much of that fascination is garnered by digital and alternative assets.

But one group of Ivey MBAs are seeking to introduce retail investors to a new opportunity in an asset class that tastes better as it ages; barrels of whiskey.

For decades, people have been investing in this liquid gold as it matured in oak casks. However, due to their hefty price tags and high investment minimums, they weren’t accessible to the most retail investors.

Ivey MBA Grant Sparling recalls the moment of inspiration while touring The Macallan estate in Scotland.

Seeing their private stock of barrels, Sparling learned that mature barrels could be worth hundreds of thousands of dollars.

“It would be incredible to invest in a barrel of Macallan! But the substantial investment amount and long holding period waiting for whiskey to mature, present significant barriers to entry,” said Sparling.

Still, he was fascinated by what was possible if those challenges could be resolved. Would there be a market for retail investors wanting a share of whiskey barrels?

An experienced entrepreneur in the beverage alcohol industry, Sparling came into the Ivey MBA program with the intention of returning to entrepreneurship in a new business.

Sharing his idea of democratizing investing in whiskey with fellow MBAs, Sparling formed a team to explore the idea further.

That was the beginning of LiquidShare, a fintech company that aims to democratise spirits investing through factional ownership of maturing casks. The platform is also seeking to create a secondary market for individuals looking to sell their shares and exit investments before the whiskey matures. Currently, no other platform exists that offers investors such an affordable entry point into this asset class.

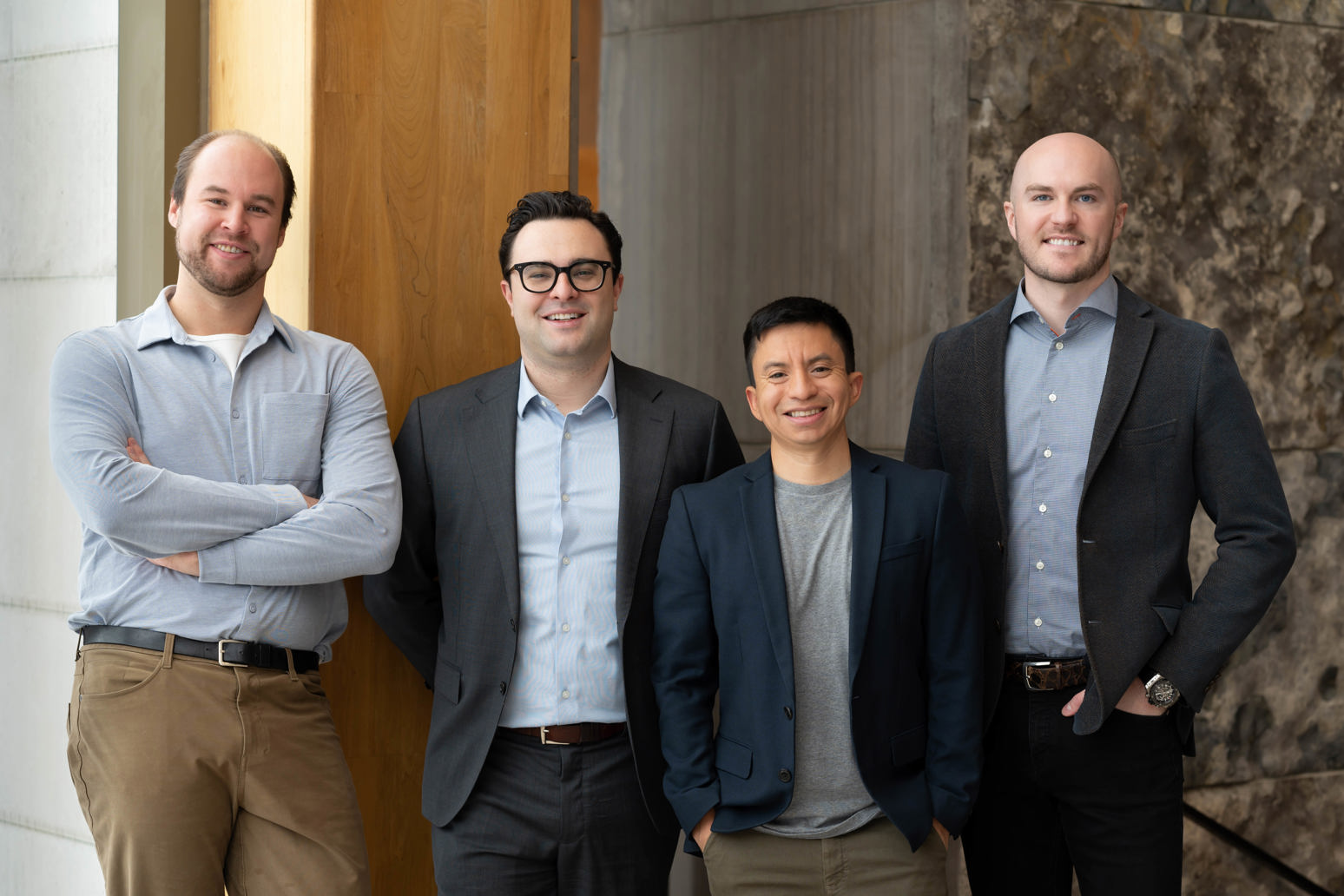

Joining him on that journey are MBA ’24 candidates Michael Cooper, Colton James, and Bruno Saux, a group of experienced and aspiring entrepreneurs who were captured by Sparling’s pitch.

The fact that they all liked whiskey didn't hurt either.

Together, LiquidShare joined the Ivey New Venture Project (NVP), an entrepreneurial capstone for students in the Entrepreneurship Stream that helps them transform ideas and concepts into fully formed business plans and investor pitches.

But for LiquidShare, the NVP course was never about a grade.

It was an opportunity to test the limits of their idea. To discover if it was truly possible and viable to launch.

Going into the new venture project, we wanted fully understand the opportunity and the market fit, and it became apparent to us very quickly that there was a viable business model here.

Michael Cooper, MBA ’24

That determination to go beyond the grade was evidenced by LiquidShare winning the Stephen Suske Prize for the New Venture Project. LiquidShare also won a spot in the winter cohort of the Western Accelerator where the team has found a space to fully dedicate their time to thinking about the business - a rare opportunity for students pursuing an MBA degree full-time.

“We have been able to connect with mentors through the program and the accelerator has helped us gain a deeper understanding of how we can turn our written business plan into a business venture that is ready to launch,” said James.

Right from the start, there was a sense of belief that their core idea had potential. That’s a belief that’s only grown stronger as they’ve continued through both programs.

“Being part of the Accelerator Program provides us a well-structured action plan, coupled with engaging and knowable speakers, and many tools that make us feel more confident with our idea”, said Saux, whose background in entrepreneurship, sports, and business has prepared him well for moving forward with this venture.

Day by day, we are facing challenges and obstacles, but we are focused on our goal to make LiquidShare a reality.

Bruno Saux, MBA ’24

There are intriguing challenges ahead, including the current Canadian regulatory landscape for fintech innovation. LiquidShare is looking to create a fully compliant platform that is accessible to as many potential investors as possible. As such, they are focusing their efforts on launching in the US, with full regulatory compliance with the SEC.

It might take some time before you can catch them on the app store, but time can sometimes be an asset; as it is for an aged barrel of whiskey.